When a Claim Turns Into a Credibility Problem

6th Mar 2026

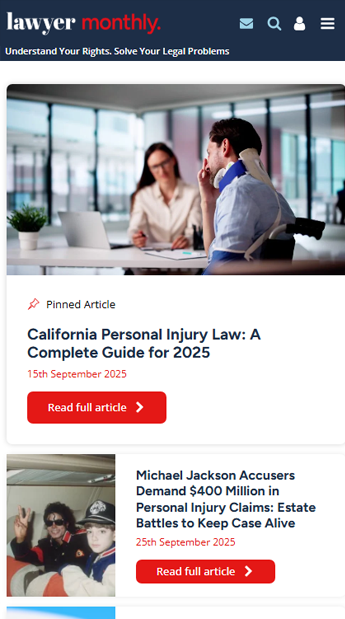

After a car accident, most people want the situation to “go away” quickly—especially if they feel embarrassed, afraid of blame, or worried about costs. That pressure is exactly where small inaccuracies can creep in, and where some people make the mistake of giving an insurer a version of events that is incomplete or untrue. In personal injury cases, credibility is not a side issue—it often becomes a core part of whether an insurer takes a claim seriously and whether a case resolves efficiently.

Even when someone is genuinely hurt, a questionable statement can create a second battle on top of the crash itself: defending the integrity of the claim. Insurance carriers may treat inconsistencies as evidence of material misrepresentation, and that can affect everything from the pace of negotiations to whether the carrier argues the injuries were unrelated. In many cases, the problem isn’t a dramatic lie—it’s a rushed answer, a guess about facts, or an “I’m fine” comment that later conflicts with medical records.

Why People “Shade the Truth” After a Crash

Car accidents are chaotic. People may be in pain, shaken up, or worried about police involvement, employment issues, or a suspended license. In that fog, someone might downplay how fast they were going, exaggerate what they saw, or deny a distraction—thinking it will protect them from trouble. But those early statements can become part of the record, and later contradictions may be used to argue the claimant is unreliable or that the injuries were exaggerated.

Insurance adjusters are trained to look for “claim friction” factors, and inconsistent statements are one of the most common. A carrier may compare the driver’s account with the police report, vehicle damage, photos, location data, or witness statements. If something doesn’t align, the insurer can use that gap to justify delays, demand extra documentation, or push a lower settlement by arguing the injuries are unclear or the claimant’s story cannot be trusted.

How Early Statements Can Shape the Entire Case

Most car accident claims begin with a basic reporting process: notice of loss, recorded or written statements, and medical documentation to confirm injury and treatment. What many people don’t realize is that insurers often treat these first communications as a foundation for evaluating liability and damages. If the foundation is shaky, the carrier may escalate the claim into a more adversarial review—sometimes resembling a “mini-investigation”—before any meaningful settlement discussions happen.

If the claim cannot resolve informally, the legal process may involve demand packages, negotiation cycles, and, when needed, a lawsuit with discovery. Discovery can include sworn testimony, medical authorizations, and requests for records that test consistency over time. When someone has made inaccurate statements early on, those errors can become the centerpiece of cross-examination, reducing leverage even when liability seems clear and the injuries are real.

What’s at Stake Beyond the Accident Itself

In most jurisdictions, a claimant’s recovery may depend on proving the other party owed a duty of care, breached it, and caused harm that resulted in compensable losses. When statements are inconsistent, insurers may argue the claimant cannot reliably establish how the crash happened or how the injuries unfolded. That creates a pathway for the carrier to dispute causation—claiming the symptoms were pre-existing, unrelated, or inflated after the fact.

Damages are also affected. Car accident compensation often involves medical expenses, projected care needs, lost income, reduced earning capacity, and non-economic harms like pain and loss of normal activities. When a claimant’s account appears unreliable, insurers may undervalue these losses, arguing the person’s reported limitations aren’t credible. The real-world consequence is that injured victims can feel forced to accept less than what they need, or they may endure a longer, more stressful process to prove what would otherwise be straightforward.

How Carriers Use Inconsistencies to Reduce Payouts

Insurance companies typically do not need to “prove” fraud in court to create problems for a claim. Often, they only need a reasonable basis to question the narrative in order to justify additional scrutiny, delays, or settlement resistance. A recorded statement that conflicts with later medical notes—such as saying “I wasn’t hurt” or “it was a minor bump”—may be used to argue the treatment was unnecessary or the injury developed from something else.

This is also where policy language matters. Many policies include cooperation requirements and allow the insurer to evaluate whether a statement is material to coverage decisions. While the legal standard and consequences vary, the practical takeaway is consistent: once credibility becomes an issue, the claim becomes harder to resolve on favorable terms. Even truthful claimants may find themselves facing repeated requests for records, pressure to sign broad authorizations, or arguments that the claim lacks reliable proof.

Repairing Credibility and Protecting the Value of the Claim

When someone has already made an inaccurate statement, the most important step is not to “double down,” but to stabilize the record with careful, accurate documentation. A strategic approach often starts with identifying exactly what was said, where it appears, and whether it can be clarified without creating new inconsistencies. In many cases, a corrected statement—supported by objective evidence like photos, medical records, timelines, and witness information—can limit the damage and refocus the claim on provable facts.

Strong legal strategy also means building a claim the insurer cannot easily dismiss. That includes documenting medical causation (why the crash likely caused the injury), tracking functional limitations over time, and presenting a coherent narrative that matches the evidence. For victims looking for broader guidance on crash claims and how liability and damages are typically evaluated, resources like Pacific West Injury car accident attorneys can help explain what to prioritize early, what mistakes to avoid, and how to protect a claim from preventable credibility attacks.

Conclusion

Lying—or even being careless with details—after a car accident can create consequences that go far beyond the initial collision. It can affect liability disputes, invite insurance resistance, and reduce settlement leverage even when injuries are legitimate and well-documented. The practical impact is often longer timelines, more invasive scrutiny, and a higher chance the insurer argues the claim is worth less than the real cost of recovery.

If you’re worried because you already said something inaccurate, it doesn’t automatically mean your claim is over—but it does mean you should move carefully. A thoughtful, evidence-based approach can often help clarify what happened and protect your rights without making the situation worse. General information, not legal advice. If you’re feeling overwhelmed, getting informed about your options—before the insurer defines the story for you—can help you make calmer decisions and regain control of the process.